What does interest mean?

Interest on investment refers to the earnings that you (investor) receive from an investment over time. When you invest, you technically lend your money to a business, government, or financial institution, and in turn, you get interest. In the simplest term, you can think of interest as a reward for allowing your money to work for you.

The role interest plays in investments

Just like well-implemented planning can lead to a smooth functioning of a household, interest can be a propeller behind the growth of your investment portfolio.

Understanding this financial concept is not just about knowing the formula to calculate interest, having a knowledge of how interest on investment works can help shape your financial future.

As such, we’ll delve into the different types of interest, the potential growth of your money, and the various ways it is calculated.

Interest as a twofold

The role of interest on investments is twofold. One, it signifies the potential growth of your money. It is an indication of how much more your investment will be worth in the future.

Two, it serves as a measure of risk. The higher the interest rates, the higher the risks and vice versa. The relationship between risk and reward is a key concept in investment decisions.

Types of Interest on Investment

Interest on investments comes in two primary forms:

- Simple

- compound

Simple Interest

Simple interest is the most straightforward type of interest. It’s calculated on the original amount of your investment. The original amount of your investment is known as “the principal”, for instance, in calculating ‘returns’ on the Federal Government of Nigeria Savings bond, you will get your interest and principal.

The formula for calculating simple interest is:

I = PRT

I is the Interest

P is the Principal which is the initial amount of money that is invested.

R is the Rate which is the annual interest rate expressed as a percentage

T is the Time which is the time period for which the money is invested, usually measured in years.

An advantage of this type is its predictability – you always know what you’re getting. However, its downside is that it doesn’t account for the effect of reinvesting earned interest.

Simple interest calculation:

Let’s say you invest $10,000 USD in a Certificate of Deposit with an annual simple interest rate of 5% for 5 years.

Here is how to calculate the simple interest on an investment where the principal is $10,000, interest rate of 5% for 5 years:

Formula:

Simple Interest = Principal X Interest Rate X Time

Principal = $10,000

Interest Rate = 5% = 0.05

Time = 5 years = 5

Calculation:

Simple Interest = $10,000 X 0.05 X 5 = $2,500

Interpretation:

This means that you will earn $2,500 in interest over the course of the investment. So, After 5 years, you will have earned $2,500 in interest, bringing your total investment to $12,500 USD.

Compound Interest

Some investment specialists refer to compound interest as interest on interest or magic of reinvestment. Compound interest is calculated on the principal amount and the interest that has been added to it. This can significantly boost your investment growth over time, especially if the interest is compounded frequently.

Compound interest calculation

The formula to calculate compound interest is:

A = P (1 + r/n) ^ (nt)

where A is the amount of money accumulated after n years, including interest. P is the principal amount, r is the annual interest rate (in decimal), n is the number of times that interest is compounded per unit t, and t is the time the money is invested for in years.

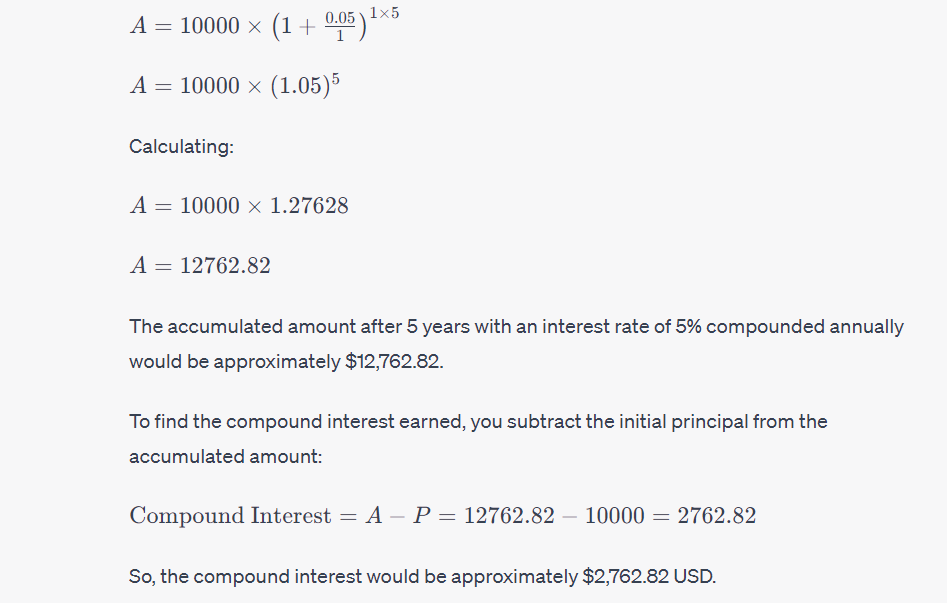

Let’s say you invest $10,000 USD with interest rate of 5% for 5 years, the compound interest will be $2,762.82

Here is the analysis:

Principal = $10,000

Interest rate = 5% = 0.05

Number of years = 5

Compound interest = $10,000 * (1 + 0.05)^5 – $10,000 = $2,762.82

The compound interest is the amount of interest earned on the original investment, plus the interest earned on the interest that has already been earned. In this case, the interest is compounded annually, so the interest earned each year is based on the principal amount plus the interest earned in previous years.

Don’t forget that compound interest offers potentially higher returns, you must also prepare for the greater risk that comes with it.

Effect of interest

The impact of interest on your investments cannot be taken with levity because even a small interest rate difference can result in a significant disparity in returns, especially for long-term investments where compound interest comes into play.

For instance, one offers a 5% return and another offers 6%. While the 1% difference may seem small, the effect of compounding over several years can result in a substantial difference in total returns.

Factors that influence interest in investment

The interest you get on your investment is influenced by several variables, they include:

- The term of the investment (the play of time)

- The rate of interest (the interest rate)

- The state of the economy,

- Inflation rates,

- Personal risk tolerance

The term of interest

Whether short or long, the term of investment can greatly affect how much interest you earn. Generally, the longer your money is invested, the more interest it can potentially accrue. This is especially true in the case of compound interest, where the time factor can truly bring out the ‘magic of compounding.’

Influence of interest rates:

A higher rate usually translates to more interest income. However, it’s crucial to understand that high-interest rates often signify higher risk. Balancing the potential return against the associated risk is a fundamental skill in investment management.

Personal risk tolerance:

The investor’s risk tolerance matters. Higher interest rates often come with higher risk. If you’re a risk-averse investor, you might prefer lower but more stable returns. On the other hand, if you have a high-risk tolerance, you might opt for investments offering high-interest rates.

Impact of inflation:

Inflation is the general increase in prices over time. If interest rates on investments don’t keep pace with inflation, the real value of your returns could be impacted. As an investor, it’s essential to consider the projected inflation when making investment decisions, especially in an unstable economic environment.

The state of the economy:

The overall economic condition can have a substantial impact on interest rates. During prosperous periods, interest rates may rise as businesses are willing to borrow and invest more. Conversely, in a sluggish economy, central banks might lower rates to stimulate borrowing and spending.

How to maximize interest

What are the strategies to maximize your returns? Here are a few tips to help you carefully choose the investment that will add value to your money in the long-term:

Consider high-interest investments:

Choosing a high-interest investment will be determined by your risk tolerance. High-interest investments often offer a greater return for your capital, aiding in wealth accumulation over time.

But remember, higher returns often come with higher risks. It’s crucial to carry out thorough research and possibly seek professional advice before committing your funds.

Proper timing:

When it comes to interest, timing can play a significant role, you have to be calculative. Making an investment when interest rates are favorable can increase your potential returns. Keep an eye on economic indicators and market trends to recognize the best times to invest, particularly in a developing economy where economic policies can change over time.

Embrace the power of compounding:

Investments that offer compound interest can significantly enhance your earning potential, especially over the long term. Even if the rate is slightly lower than simple interest options, the compounding effect may result in higher total returns in the long run.