When you hear central bank, the first thing that comes to mind is a country’s apex financial institution, that is, the bank that controls the monetary activities and the activities of banks in a country.

But the advent of cryptocurrencies like Bitcoin, Ethereum, and other altcoins had pushed the responsibilities of the central bank beyond just fiat currencies, they now have roles to play in the digital age. That’s what brought about Central Bank Digital Currency (CBDC). We’ll explore the workings of CBDC, its genesis, its benefits, and challenges and risks.

What is Central Bank Digital Currency (CBDC)?

A Central Bank Digital Currency is a digital form of a country’s physical money which is pegged to the physical cash. While CBDC and cryptocurrencies are digital assets, CDBC is issued, controlled, and regulated by a country’s central bank.

The Central Bank Digital Currency or CBDC is a type of digital currency that is issued and directly controlled by a country’s central bank. It is not a type of cryptocurrency or digital asset like BTC or ETH.

CBDC is a fusion of the old and the new currency. It combines the stability and trust of traditional currency with the agility and innovation of digital currencies.

The genesis of digital currencies

The evolution of CBDC is a testament to the world’s digital transformation. As technology advances, our methods of trade and transaction also evolve. CBDC is the newest member of the financial evolution.

But it is important to note that the quest for central bank digital currency didn’t start today, it is something that apex banks had been working on since the 1990s.

First digital currency in Finland and Czech:

For instance, what we know as e-Money today can be traced to Finland’s Avant with its e-money card in the 1990s.

In 2000, the Czech Republic launched a similar project named, “I LIKE Q” which enabled the implementation of micropayments on the Internet. It enabled users to use virtual currency which was tied to a fixed exchange rate against the Czech koruna in the ratio of 100 Q = CZK 1. Both currencies were fully convertible.

Unfortunately, a new amendment law in Czech led to the termination of “I LIKE Q” project in 2003.

So, the concept of central bank digital currency isn’t strange in the field of economics whereby individuals can hold accounts with it and use it as medium payment.

A December 2020 report by the Bank for International Settlements (BIS) says there would be at least 80 central banks that are looking at digital currencies by April 2021.

Bitcoin sparked the digital money revolution:

Limited technology restricted the development of digital currencies in the 1990s, but by 2008, the invention of Bitcoin sparked a digital currency revolution.

It made it possible for individuals to perform secure online transactions without the need for middlemen, although Bitcoin and altcoins had volatility issues and were not regulated by any central authority.

The need for control brought about Central Bank Digital Currency. As such, its goal was to retain the benefits of crypto – fast and secure transactions – but in a stable and regulated way.

Launching of digital currency:

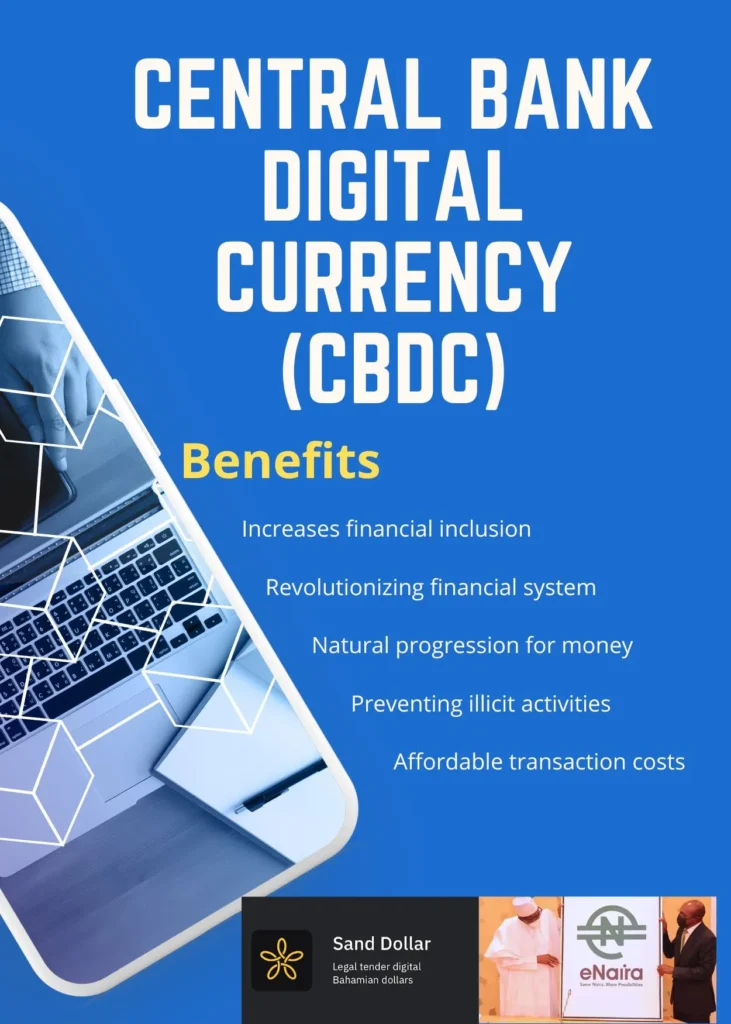

While the apex banks of several countries were studying the pros and cons of having the digital version of their paper money, The Bahamas took the lead, becoming the first country to launch its CBDC in October 2020 which it called the Sand Dollar.

On October 25, 2021, Nigeria became the second to launch CBDC called eNaira. Other countries like China, the United States, and the European Central Bank are studying the potential of digital currency.

The influence of monetary policy on CBDC

Central banks of a country factor in monetary policy before designing their own digital form of currency because its circulation will also affect the economy. Factors like interest rates, and money supply are considered.

Difference between CBDC, fiat currency, and cryptocurrency

The main difference between CBDC, traditional currency and cryptocurrencies is the way they operate.

Think of CBDC as a digital form of the US Dollar, digital form of Naira, or digital form of British Pound Sterling etc. CBDC represents a new frontier for a digital economy.

Traditional money is physical. You can see, touch, and feel traditional money such as USD, but CBDC and cryptocurrency can not be touched or withdrawn at the ATM.

CBDC and crypto entirely exist online, they are not physical. You can’t hold them the way you hold dollars and cents in your hands.

While Cryptocurrencies are decentralized, CBDC is centralized, issued and directly controlled by a country’s apex bank. Cryptocurrencies are not issued by a central bank.

Like fiat currency or traditional currency, CBDC has the backing and regulations of a central authority. CBDC provided the advantages of a digital format like fast transactions and convenience.

Another distinction between cryptocurrency and CBDC is that crypto is highly volatile, it can fluctuate in a mysterious way. But CBDC like a digital dollar have a more stable value than BTC, ETH etc.

How does CBDC work?

Like we earlier pointed out, CBDC works similarly to traditional money, but with one key difference: CBDC is completely digital.

It is issued and regulated much like they do with physical money by the central bank of a country.

The technology behind CBDC

CBDCs rely on blockchain and Distributed Ledger Technology (DLT). These technologies act like digital ledgers to record transactions.

Its design and implementation is a complex process. It needs robust security, transparency and careful integration into the existing financial framework.

Acceptance

The success of a digital version of a country’s currency depends on its adoption by businesses, individuals, and institutions. Consumer trust and acceptance will also play a huge role.

Nigeria’s digital form of the naira, for instance, faced adoption issues because of trust and poor publicity. So, if people feel safe and find value in using it, adoption will likely increase.

Benefits of CBDC

Why should a country care about the digital form of its currency? Here are the benefits of CBDC.

1) Increases financial inclusion:

A 2021 Survey of Unbanked in the United States by the Federal Deposit Insurance Corporation (FDIC), reveals that there were 5.9 million U.S households (an estimated 4.5%) were unbanked, meaning 5.9 million U.S households had no checking or savings account at a bank or credit union.

Another research in 2021 by Global Finance and Merchant Machine states that 71% of Morocco’s 36.9 million population was unbanked; 69% of Vietnam’s 97.3 million people is unbanked and 67% of Egypt’s 102.3 million population was unbanked.

Overall, the research ranked Morocco, Vietnam, Egypt, the Philippines, and Mexico as the top five most unbanked countries in the world.

Apart from the speed, CBDC is designed with the goal of increasing financial inclusion. You might be wondering HOW?

It could reach people without access to conventional banking, particularly people in remote areas of a country, where traditional banking services may not be available.

2) Revolutionizing the financial system:

Imagine the speed and ease of digital currencies but with the security and reliability of traditional money. CBDC is revolutionizing the financial system.

3) Natural progression for money:

Once upon a time, a means of trade was trade by barter. The world moved from that system to gold and silver to paper money or fiat currency. Now, traditional currencies are in digital form. CBDC can be described as a step in that ongoing evolution.

4) Preventing illicit activities:

As a digital currency that is within the control of the central banks, it gives them the power to regulate, thereby preventing the illicit use of digital money. Transactions can be traced which will help the central authority to detect money laundering and other financial crimes.

5) Affordable transaction costs:

With CBDC, transfer fees which is associated with the traditional banking system are reduced. As such, CBDC makes money transfers more affordable for everyone.

Risks of Central Bank Digital Currency

From economic to regulatory concerns, there are a few challenges and risks associated with the adoption of Central Bank Digital Currency, they are:

1) Economic risks:

If CBDC enjoys a huge adoption and acceptability, so, what happens to traditional money? If people move their fiat currency to CBDC, it could destabilize the banking system. It could also pose potential issues with price stability and monetary policy transmission.

2) Technological risks:

While blockchain is considered safe, CBDC could face hacks and data breaches. There had been cases of exchanges that is backed by the same technology and experienced security breaches. So, CBDC isn’t an exception.

3) Legal issues:

Launching and adopting CBDC requires an extensive review and amendment to the existing monetary policies of a country. As such, this would also trigger some changes in privacy, data protection, terrorism financing, and money laundering.

Rishi Sunak a Chancellor in 2021 explains in this video what Central Bank Digital Currencies are and how they could revolutionize the way we do business:

Is CBDC secure?

What are the types of CBDCs?

What are retail CBDCs?

What are wholesale CBDCs?

Conclusion:

Central Bank Digital Currency (CBDC) is an exciting concept that could reshape the way we transact and do business globally.

While it brings a lot of benefits such as expanding financial inclusion, its economic challenges are some of the things that make countries like the U.S., the U.K., and the EU take their time to study its pros and cons.