Meaning of Cash Flow

Cash flow refers to the total amount of money being transferred into and out of a business. In simple terms, it is the movement of money in and out of your business.

Table of Contents

Whether it’s due to unexpected expenses, slow-paying customers, or seasonal sales fluctuations, cash flow problems can put a severe strain on your startup’s resources and resilience.

Basics of Cash Flow

It’s the lifeblood that keeps the heart of your business beating, ensuring your startup’s operations run smoothly, your employees are paid, your bills are covered, and your potential for growth is viable.

Think of cash flow as the financial oxygen to your startup, without which your business may suffocate and eventually cease to exist.

Yet, many startups find themselves grappling with cash flow problems at some point in their journey.

Different types of cash flow

There are three key types of cash flow you should consider in your business, they are:

- Operational

- Investment

- Financing

Operational cash flow:

This represents the cash generated from your primary business activities. It includes income from sales, payments to suppliers, salaries of employees, and other regular business operations.

Investment cash flow:

This is the cash used or generated from a company’s investments, like the purchase or sale of asset, equipment, or investment securities.

Financing cash flow:

This covers the movement of cash between the business and its owners, investors, or creditors. Examples include loans, repayments, issuance of stock, or dividend payments.

When your business brings in more cash than it sends out, you’re experiencing positive cash flow, a sign of financial health. Conversely, if expenses outpace income, negative cash flow ensues, potentially leading to cash flow problems and could eventually lead to financial strain.

Effect of cash flow problems

Struggling to pay employees:

Employee wages form a critical part of any business’s expenses. If your business has trouble meeting payroll obligations, it may signal a significant cash flow problem.

Difficulty in paying bills on time:

This is often the first sign of a cash flow problem. If you find your business constantly struggling to settle bills or meet other financial obligations, it might be facing cash flow issues.

Strain on daily operations:

The first area to take a hit when cash flow becomes a problem is daily operations. Inadequate cash can lead to difficulties in maintaining inventory levels, paying rent or utilities, or meeting other operational costs. This can cause disruptions that might lead to lost sales or reduced productivity.

Difficulty in retaining employees

Consistent cash flow problems could also result in delays in salary payments, causing a drop in employee morale and potentially leading to a high turnover rate. The costs of recruiting and training new employees could further strain your already tight cash flow.

Inability to pursue growth opportunities

One of the more significant casualties of cash flow problems is missed opportunities. When your business is preoccupied with staying afloat, it becomes nearly impossible to take advantage of growth opportunities, be it investing in new equipment, upgrading technology, or expanding to new markets.

Risk of business failure

In severe cases, ongoing cash flow problems could even lead to insolvency. If a business continually spends more than it earns and accumulates debt it can’t repay, it may be forced to close its doors for good

Early Warning Signs of Cash Flow Problems

1) Regularly overdue bills: If you’re frequently missing payment deadlines, it might be an early sign of a cash flow problem.

2) Difficulty meeting payroll obligations: Struggling to pay your employees on time is another red flag.

3) Increasing business debt: A rapid increase in business debt is a serious warning sign.

4) Low or decreasing cash reserves: If your cash reserves are constantly low or shrinking, it’s a signal to review your cash flow.

What Are The Practicable Ways to Solve Cash Flow Problems?

1) Efficient invoice management: Prompt invoicing and following up on unpaid bills can help ensure a steady cash inflow.

2) Cost control and reduction: Regularly review your expenses to find areas where you can cut costs without affecting operations.

3) Effective inventory management: Holding too much inventory ties up cash. Opt for practices like Just-In-Time (JIT) inventory management.

4) Securing a Line of Credit: Having access to a line of credit can be a lifesaver during periods of tight cash flow.

4) Regular cash flow analysis: It is important to routinely analyzing your cash flow statement (see sample here) can help detect issues before they become significant problems.

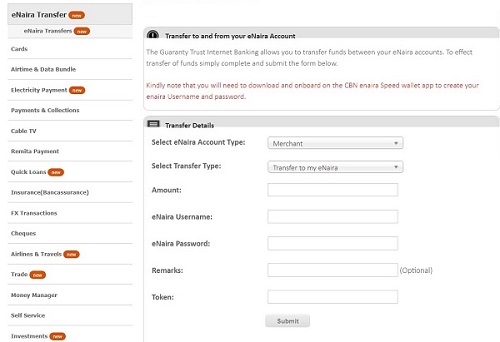

Tools to Aid Cash Flow Management

We are in a digital age and technology has presented a solution to almost every business challenge, like the way technology has been deployed to minimize or solve problems in other sectors, such technology tools can be helpful in cash flow management

Cash flow management software

These are specialized applications designed to automate and simplify all aspects of cash flow management. They can help with everything from creating cash flow forecasts to tracking income and expenses.

Examples include:

- QuickBooks,

- Xero, and

- Float

Invoice and payment tools

Getting paid on time is crucial for maintaining a healthy cash flow. Tools that can automate invoicing and payment reminders, ensuring you’re paid promptly include:

- FreshBooks,

- Square, and

- Zoho

Financial planning and analysis software

There are lots of tools that can provide comprehensive financial planning and analysis features, allowing businesses to create financial forecasts, budgets, and reports, some of them include:

- PlanGuru,

- Scoro, and

- Vena

Takeaways

Cash flow is the movement of money in and out of your business. Understanding its intricacies is the first step towards managing it effectively.

You need to identify cash flow problems such as regular overdue bills, difficulty meeting payroll, and increasing business debt before it gets out of hand.

Technology and software tools can aid in cash flow management, making it more efficient and less time-consuming.