Last updated on May 24th, 2024 at 04:15 pm

Nigerian Education Loan Fund (NELFUND) opened its portal for application on Friday, May 24, 2024, after several amendments to the Access to Higher Education law establishing it.

Table of Contents

The application process is divided into segments, you will have to start by creating an account by clicking on “GET STARTED” to fill in the questions, move on to complete your profile and then proceed with the loan application.

Here is the step-by-step guide on how to apply for the Nigeria Students’ Higher Education Loan:

Stage 1: Creating An Account

Step 1: visit http://nelf.gov.ng

Step 2: Click on the “Apply Now”

Step 3: Click on “Get Started”

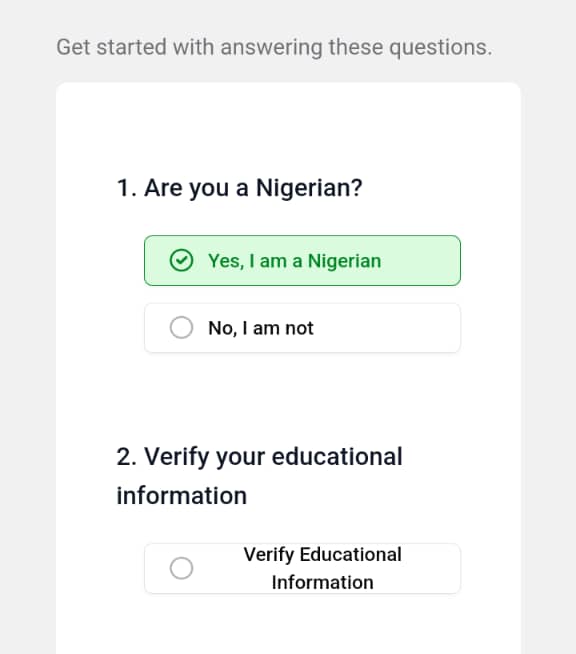

Step 4: Answer the questions on this page to continue by clicking on “Yes, I am a Nigerian”

Step 5: Verify your educational information. You would be required to select your school from a dropdown and provide your matric number to check if your school has uploaded your details.

Step 6: Click the “Verify with JAMB” and enter your JAMB details in the screen.

(Students whose NIN has not been registered with JAMB will have an input field where they can enter their NIN for validation.)

Step 7: Create an account by entering your Email address, Password and Confirm Password in the fields provided and click “Create Account”.

Step 8: Click the email verification link sent to your email. This concludes the process of creating an account.

Stage 2: Complete your profile

After successful registration, log in by clicking the “LOGIN” button.

Step 1: Enter your email address and password to Login.

Step 2: Click on the “Proceed to Contact Details” button.

Step 3: Update contact details with the current information of your Phone Number, Full Residential Address, State of Residence and Local Government Area of Residence and click “Proceed to Educational Details”

Step 4: Update your educational details by selecting your Higher Institution and inputting your Matric Number, then click “Proceed to Account Details”

Step 5: Verify your BVN by entering your BVN, select your Bank Name and enter your Account Number. Click “Save Changes” to complete your profile.

Stage 3: Apply for the loan

Step 1: Click on the “Request for Student Loan” button at the top right of the screen on the home or loans page after logging into the application.

Step 2: If you want an upkeep loan, click the check box, and click Continue, if all you need is the institutional charge, click the “Continue” button.

Step 3: Upload supporting documents. The admission letter is compulsory which the Student ID and Institution Invoice are optional. Click the checkbox for the policy and declaration and click “Continue”

Step 4: Read the loan overview and click the checkboxes for both the Terms & Conditions and GSI Mandate then click “Submit Application”

Step 5: Click on the “Loans” button to view the status of your application.

“This student loan scheme is available to students who are in government institutions at the tertiary level,” the Managing Director of NELFUND, Akintunde Sawyerr, said during a pre-application sensitisation conference held in Abuja on Monday, May 20, 2024.

Application challenges and solutions

Q: I can’t see any institution in the dropdown list?

Ans: Please check your internet connection and refresh your browser.

Q: My matriculation number cannot be verified on the portal?

Ans: Contact the ICT department in your school to upload your records to the Students Verification System (SVS).

Q: My school is not on the list of Institutions

Ans: Contact your ICT department to reach out to NELFUND.

Q: I’m not able to verify my account via email?

Ans: Ensure that you are entering the correct email address.

Q: My JAMB number is not verifying?

Ans: Contact your school to ensure your admission is supported by JAMB.

Q: If you are a student from any state owned institution who is trying to apply

Ans: Hold on for now, the rollout phase starts with only federal institutions.

Questions and answers about NELFUND

The Frequently Asked Questions below is our attempt to provide answers to common questions that the applicants may have regarding the Students’ Higher Education Loan in a brief and easy-to-understand way:

Q: What is the Students Loans (Access to Higher Education) Act, 2024?

Ans: The Student’s Loan Act is an Act of the Parliament that makes it possible for Nigerian students to access zero interest loans to enable them pay for institutional charges and upkeep to any higher institution of their choice within Nigeria.

Q: Is the Student’s Loan the same as the Nigerian Education Bank?

Ans: No. The Student’s Loan Act has repealed the Nigerian Education Bank Act and established a framework for providing zero-interest loans to eligible Nigerian students who desire to study at any institution of higher education.

Q: Who administers the loans to the students?

Ans: The loans will be administered by the Nigerian Education Loan Fund (NELFUND), which is the body established by law to carry out the day-to-day activities of the Fund. It is headed by a Managing Director, appointed by the President of Nigeria.

Q: Is the loan open to all tertiary institutions?

Ans: The Loan is open to all public tertiary Institutions. The first phase of the loan is open to only students studying/desiring to study in federal higher institutions in Nigeria. The other phases will be announced in due course.

Q: Who is eligible to apply for loans under this Act?

Students who have secured admission into all Public Nigerian universities, polytechnics, colleges of education, or vocational schools, with a proof of admission that includes Name, Date of Birth, Admission, JAMB number, Matriculation number, and BVN. All new and existing students within the institution above can apply for the loan.

Q: Can a Direct Entry Student into higher institutions apply for the loan?

Ans: Yes, but such a student must have a JAMB number.

Q: Will the loan be available for all students or only applicants?

Ans: All full-time students are eligible for the loan but only applicants will benefit from the loan.

Q: How much loan are students allowed to apply for?

Ans: That would be determined by the institutional charge of each Institution. The loan will cover the cost of institutional charges and upkeep if required by the student. The institutional charges will be remitted directly to the applicants’ institutions and the upkeep will be paid to the applicant on a monthly instalment basis.

Q: Will the applicant be required to make any payment before the loan is disbursed?

Ans: No payment is required before the disbursement of the loan.

Q: Is there an interest payable on the loan?

Ans: Zero interest on the loan.

Q: Is the loan open to every student?

Ans: The loan is open to new and existing full-time students in tertiary institutions.

Q: How are the loan applications processed?

Ans: Applications are done online. Applicants are required to input specific personal details that include:

- Name of Institution of study

- Admission Number

- JAMB Number

- Date of Birth

- NIN

- BVN

Q: What is the disbursement timeline?

Ans: NELFUND will disburse within 30 days of approval of successful applications.

Q: Is there age limit for applicants?

Ans: No

Q: Who is responsible for the loan repayment?

Ans: The beneficiary of the loan is responsible for the repayment of the loan.

Q: Is the loan applied for only once?

Ans: The loan will be applied for every academic session by the student.

Q: How do applicants know their application is approved?

Ans: Applicants will receive a notification and the status of the loan application can be seen in the applicant’s profile on the portal.

Q: When is the loan due for repayment?

Ans: The loan is due for repayment 2 years after the completion of NYSC

Q: What happens if a beneficiary does not have job after two years post-NYSC?

The beneficiary should notify NELFUND by sworn court affidavit every 3 (three) months after two years post NYSC if still unable to gain employment.

First phase: The loan commences with federal institutions, students in state-owned institutions will have to wait for an update from the government.

N500K income cap: Stringent requirements, which could limit access to the loan, including an income cap of N500,000 for applicants or their parents or guardians, have been removed.

Beware of fraud: Application for the loan can only be submitted at nelf.gov.ng and you can find them on X @NELFUND. Any other website or portal should be treated as fraud. Sometimes ago, some fraudsters operating the website fedstudyloan-gov.ng advertised an application for students, please ignore them and report other similar questionable portals.

Method of disbursement: The loan will cover tuition and upkeep of the students. The loan will not be handed over or paid into the account of successful applicants, rather it will be paid directly to their institutions’ account while upkeep will be credited into the students’ bank account. The fees would be paid per session.

Child of loan defaulters: Initially, children of loan defaulters can’t apply, but that rule no longer applies, it has been removed. Your parent’s debt profile should not limit your academic pursuit.

Beneficiary of existing loan: You cannot apply if you are a beneficiary of an existing government loan or scholarship.

Repayment plan: Loan repayment will begin two years after you’ve completed your mandatory National Youth Service Corps (NYSC)

Origin of Student Loan Bill in Nigeria

In 2016, Honorable Femi Gbajabiamila who was then Leader of the House of Representatives pushed for legislation titled “Bill for an Act to Provide for Easy Access to Higher Education for Nigerians Through Interest-free Loans from the Nigerian Education Bank”.

The Bill didn’t receive the kind of acceleration that a few Bills received until 2022 and on November 23, 2022, when both chambers of the National Assembly passed the Student Loan Bill.

By 2022, the title of the Bill had been shortened to “Students Loan (Access to Higher Education) Bill, 2019,”.

In essence, the Bill started during the administration of former President Muhammadu Buhari. However, he was unable to sign it, leaving it for his successor.

Gbajabiamila who is now the Chief of Staff to President Tinubu witnessed the signing of the student loan bill into law at the Presidential Villa in Abuja on June 12, 2023, but it was later amended due to the stringent requirements, for instance, applicants must have two guarantors who must be senior government officials in the last provision, but that have now be removed.

Everyone is equal under the Access to Higher Education Act

What is Student Loan Law?

A new student loan in Nigeria now known as the “Access to Higher Education Act” is a law backing the access of undergraduates to loans at the Nigerian Education Bank which is now known as the Nigerian Education Loan Fund (NELFUND) which enables them to complete their post-secondary education and the associated fees, such as living expenses, tuition, and books and supplies.