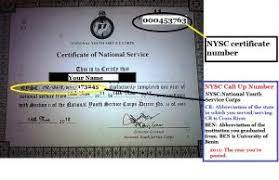

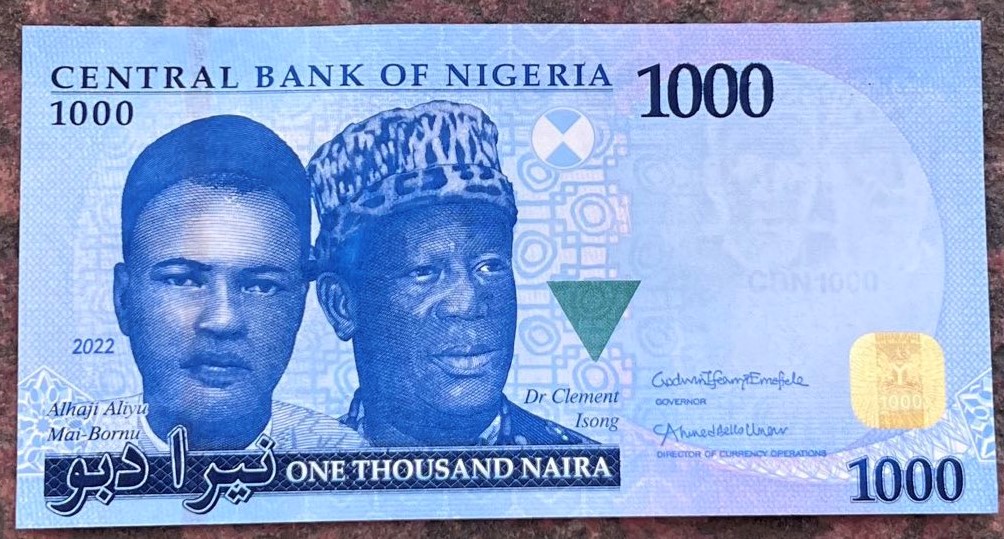

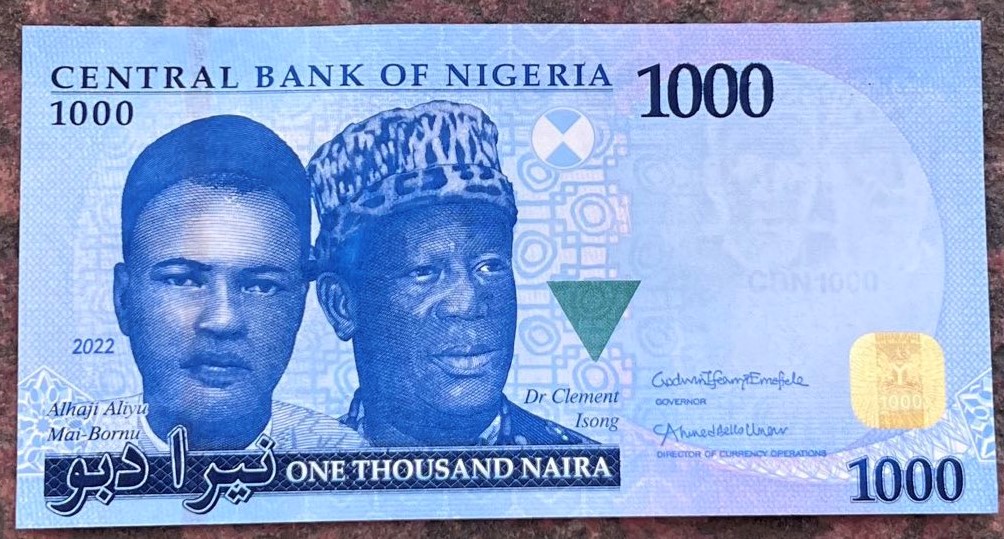

The journey to drag millions of Nigerians into suffering and cripple their businesses and means of livelihood started on October 26, 2022, when the governor of the Central Bank of Nigeria (CBN) Mr Godwin Emefiele announced its plan to implement naira redesign policy.

Table of Contents

The naira redesign was part of the plan by the Federal Government to fully implement a cash-less economy and drastically reduce vote buying among other benefits of naira redesign policy.

But a few days when the old naira notes – NGN200, NGN500, and NGN1,000 – were redesigned and launched, it was clear that the CBN governor had added personal political interest into his much-advertised cash-less policy.

How naira swap policy collapsed Nigeria’s economy

Initially, the CBN announced that Nigerians should deposit their old naira notes at banks in exchange for the new naira notes.

Unfortunately, millions of Nigerians who deposited the old notes were unable to get the new notes, they got stranded, and their businesses collapsed.

Point of Sales popularly known as POS operators in their thousands closed their shops because they didn’t have the new naira notes.

The online banking app that was supposed to support the cashless policy also collapsed because most of the financial institutions were not ready for the mammoth use of their apps.

In a statement by the Kaduna state governor, Mallam Nasir El-Rufai said what Emefiele implemented was currency confiscation and not currency swap.

El-Rufai accused the CBN of withdrawing over NGN2 Trillion from circulation but “printed only N400 billion, so in effect, currency confiscation was then unilaterally and unlawfully implemented by the CBN.

“Trade and exchange have collapsed. Human suffering, impoverishment and economic contraction resulted,” the former FCT minister said.

CBN ignores Supreme Court ruling

Angered by the destruction of banking properties that followed the naira scarcity, some state governments – over 10 of them – dragged the APC-led government of Muhammadu Buhari to the Supreme Court.

The judgement was in favour of the plaintiffs, but the Federal Government failed to respect the ruling of the highest court in the land.

On March 3, 2023, the Apex court gave its final ruling that the old naira notes should circulate alongside the newly redesigned notes till December 31, 2023.

Unfortunately, the Buhari-led government through Emefiele-led CBN kept mum, they refused to obey the court order.

A lawyer and Intelligence Reform Expert, Dr. Charles Omole in a tweet described the silence of the FG and CBN on the court ruling as a disgrace that would come with consequences.

“Ten days after the Supreme Court judgement on Naira redesign, PMB and Emefiele are still silent and disregarding the verdict. This is a disgrace.”

Nigeria’s economy loses NGN20 trillion to Naira scarcity

Weighing the impact of the naira swap/redesign policy, the Director of the Centre for the Promotion of Private Enterprise (CPPE) Dr. Muda Yusuf disclosed in a report that the Emefiel-led naira redesign policy and naira confiscation led to Nigeria’s economy losing at least NGN20 trillion.

The report says:

“Millions of citizens have slipped into penury and destitution as a result of the disruptions and tribulations perpetrated by the currency redesign policy, especially the mopping up of over 70 per cent of cash in the economy”.

The Punch

Yusuf said that Nigeria’s economy is gradually grinding to a halt “because of the collapse of payment systems across all platforms.”

Banks should start accepting and dispensing old naira – Soludo quotes Emefiele

After the ruling of the Apex Court, state governors persuaded residents in their state to start accepting the old naira notes, some even threatened to sanction sellers who reject the old notes.

While the CBN remains mum, the governor of Anambra state who was also former CBN governor Prof. Charles Soludo issued what he called a “special public announcement”, directing banks to start accepting the old notes.

Soludo stated that Emefiele gave the directive at a Bankers’ Committee meeting held on Sunday, 12th March 2023.

Although, the CBN official social media handles had no update about the court case, but Soludo hinted that he personally “confirmed the above to me during a phone conversation on Sunday night.”

But concerned Nigerians are saying there should be a public statement either from the CBN or a representative of the FG stating compliance with the verdict of the Supreme Court.

Buhari dissociates self from CBN’s disobedience to court ruling

In what seems like a transfer the naira scarcity disaster blame to the Apex bank, Buhari through his media aide said he didn’t have to direct Emefiele to obey the court ruling.

The Senior Special Assistant to the President, (Media & Publicity), Garba Shehu, said no time since 2015 has the president directed anyone, “to defy court orders, in the strong belief that we can’t practise democracy without the rule of law and the commitment of his administration to this principle has not changed.”

Emefiele bows to pressure

In a message that portrays a defeat, the Emefiele-led CBN stated that it reverses self from the further implementation of the naira swap and cash-less policy.

“In compliance with the established tradition of obedience to court orders and sustenance of the rule of law principle that characterised the government of President Major General Muhammadu Buhari (retd.), and by extension, the operations of the Central Bank of Nigeria, as a regulator, Deposit Money Banks operating in Nigeria have been directed to comply with the Supreme Court ruling of March 3, 2023.

@cenbank

The statements from the presidency and the management of the apex bank have laid to rest concerns over compliance with the Supreme Court ruling.

Will the CBN now release enough naira notes to circulation to lessen the suffering of Nigerians over their inability to access their money?