If you live in Nigeria or you’re a registered person or entity, you need to have a Tax ID Number. So, this article covers everything you need to know about TIN, including how to obtain one, how to verify it and how to remit your tax to the government online.

Table of Contents

What is a Tax Identification Number?

It’s a unique identification number given to all registered persons/entities by the Federal Inland Revenue Service (FIRS) which is used for payment of all tax types.

It is associated with every taxpayer in Nigeria. Note that Nigeria does not issue separate TIN for different taxes.

Who issues TIN in Nigeria?

The Federal Inland Revenue Service (FIRS) is in charge of tax collection on behalf of Nigeria’s government, which they remit to the Federation Account.

It has the power to adopt measures to identify, trace, freeze, confiscate or seize proceeds derived from tax fraud or evasion.

FIRS has the power to direct banks to restrict taxpayers’ accounts on the ground that such taxpayers have outstanding tax liabilities to settle.

Benefits of Tax Identification Number

Here are the reasons you need to have a Tax ID in Nigeria:

- It enables you to apply for a government loan.

- Bid for government contracts.

- You need TIN to bid for property auctioned by the government.

- To enjoy government loans and funding, you need to show evidence of tax payment.

- Some foreign-owned companies may ask you to produce it to get payment clearance.

- You need a Tax ID if you are in the import and export sector.

- If you’re planning to import your capital from a foreign country.

- It is needed to apply for Form A

- It is mandatory to open a business account (corporate account) at the bank.

- It is a must when registering your vehicle.

- You also need a TIN to get tax clearance, allowance, waiver, incentive.

What You Need To Get a TIN

- Legal name (not alias or pet name)

- Means of identification (ID) e.g Driver’s license, National ID card, International Passport, Staff ID card.

- Physical address

- Your BVN or NIN (National Identity Number)

- Phone number

- Functional email address

- Functional phone number

How to obtain a Tax Identification Number on the FIRS portal

This process is divided into two:

- Individual

- Non-Individual

Individual include:

- Salary earner

- Market women

- Service provider

- Hawkers etc

Non-Individual include:

- Sole proprietorship

- Incorporated trustee

- Foreign companies

- Limited by guarantee

- Partnership business

- Private Limited Company

- Private Unlimited Company

- Public Limited Company

- Cooperative Societies

- Trade associations

- Business name etc

Application Process for Non-Individual

- Access the official portal of JTB at tin.jtb.gov.ng/TinRequestExternal

- Fill out the form by selecting organisation type, line of business, business registration number and registered name etc.

- Provide details of directors: full name, phone number, email, address, shares. You could click add to provide details of other directors of the company.

- Hit submit to generate your tax identification number (TIN).

Note: Your TIN has to be Join Tax Board TIN only

Requirements for Non-Individual

The requirements for a Corporate Business are:

- Certificate of Incorporation: CAC2, CAC7

- Utility bill of one of the directors

- Application letter on company letter-headed paper

- The company seal (stamp)

- Memorandum

- Articles of Association

- Duly completed TIN Application form

Make photocopies of the above documents and ensure to take the originals along with you for verification purposes. They would be returned to you.

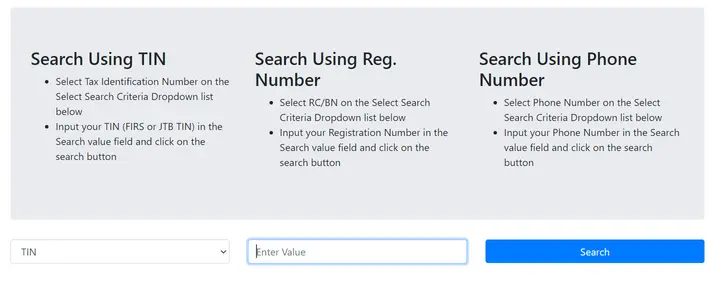

3 Ways To Verify Your TIN

To verify your Tax ID, you need to visit a tax office closer to you register on TaxPro Max and pick any of the methods below:

- Using Tax ID number

- Using your CAC registration number

- Using your phone number

Using Tax ID number

- Head to the official search form portal of FIRS at: apps.firs.gov.ng/tinverification

- Choose from the drop-down menu “TIN”

- Enter your TIN (FIRS or JTB TIN) in the Search value field

- Click on the search button to see your tax ID number come up

Using your CAC registration number

If you have forgotten your Tax identification, there is another option for you, it’s by using your business name or company registration number issued to you by the Corporate Affairs Commission also known as BN or RC

- Follow step 1 above but this time, choose “CAC Registration number” in the search criteria dropdown list

- Input your CAC Registered number eg RC139844 (for company) or BN4627838 (sole proprietorship)

- Click the search button and wait for the portal to display your tax ID

Using your phone number

- On the search portal, choose ‘Registered Phone Number’ from the dropdown list. The phone number must be the valid number used during the tax ID application process

- Enter your phone number

- Tap on the search button and see your tax ID number come up

How to Retrieve a TIN Number

Have you forgotten your Tax Identification Number or you lost it? You can use the FIRS TIN Verification System by using your CAC registration number or your phone number to retrieve your lost TIN.

Alternatively, you should visit the nearest FIRS office in your state and request assistance.

What is JTB?

JTB means Joint Tax Board. The Income Tax Management Act 1961 created the Joint Tax Board (JTB) charged to ensure uniformity of standards and application of Personal Income Tax in Nigeria.

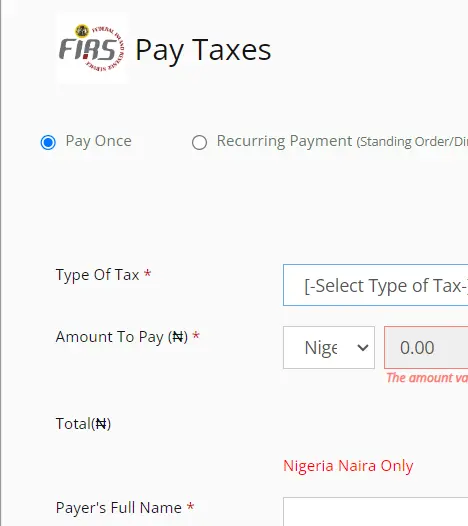

How To Pay Your Tax Online

- Go to the the FIRS e-tax payment platform at: taxpromax.firs.gov.ng

- Click on any of the payment channels – remita, pay online, interswitch, NIBSS, and e-Tranzact – to make your online payment.

- Select the type of Tax. There are 28 listed types of taxes listed by the FIRS

- Follow other instructions to make payment.

Just as the FIRS is associated with the FG, the States Boards of Internal Revenue (SBIRs) are associated to the 36 state governments while the Local Government Revenue Committees perform similar functions at the grassroots level.

Takeaways

- TIN is free unless you want to commission an accredited

- It is a legal obligation of every Nigerian

- Paying taxes is mandated for all Nigerians and foreigners who reside in Nigeria

- As mandated by the law, you are expected to pay tax on your earnings every year according to the new tax law in Nigeria